For REAL ESTATE INVESTORS AND BUSINESS OWNERS Paying $30,000+ In Taxes

We'll Legally Cut Your Tax Bill With Our Custom TailoredStrategic Tax Planning System And Help You Direct It Toward Building Wealth In 2026 (Without Earning A Single Penny More)

And Without Studying Tax Law, Dealing With IRS Audits, Or Spending All Your Time

Tracking Deductions

WATCH THE VIDEO BELOW

STEP 1: FILL OUT A SHORT SURVEY

For REAL ESTATE INVESTORS AND BUSINESS OWNERS Paying $30,000+ In Taxes

We'll Legally Cut Your Tax Bill With Our Strategic Tax Planning System And Help You Direct It Toward Building Wealth In 2026 (Without Earning A Single Penny More)

And Without Studying Tax Law, Dealing With IRS Audits, Or Spending All Your Time Tracking Deductions

WATCH THE VIDEO BELOW

STEP 1: FILL OUT A SHORT SURVEY

WHAT CLIENTS THINK ABOUT

BUDGETDOG TAX

Saved $33,000 in taxes with cost segregation

"Before I started working with you I really felt like I was in the dark... I had like zero knowledge... I didn't even know what a cost segregation was. The benefits [of working with you]... was of course the cost segregation, like being able to save money on taxes... and then another benefit is just being able to have someone there as support."

Audrey, Travel Nurse

Caught a $24,000 mistake by another tax firm

"They insisted that they had experience with short-term rentals... my first tax return came in and I would have gotten $6,000 back... I thought 'that looks a little weird.' They'd forgot my cost segregation study... they had put my short-term rental on my schedule E instead of my schedule C... Now I'm getting $24,000 back from the government... that's a very significant difference."

Amy, Teacher

Transitioned from W2 to full-time real estate with strategic tax planning ($98K in tax savings)

"It's been kind of interesting being a client of yours and just making the transition from a W2 to doing short-term rentals full-time and then... now it's a pretty big business that I'm growing."

Kathi, STR Investor

Offset his lifetime pension with real estate deductions

"It really set me in the position to be able to offset my lifetime pension with my real estate so that... I don't have to pay as much to Uncle Sam... being educated and understanding how to use it is key and very clutch."

Glenn, Real Estate Investor

Finally found a CPA who gives practical advice

"You are far and away the best CPA I've ever worked with... I've been through probably four or five... I tried going to tax attorneys before and it's always like 'well it kind of depends' rather than just practical advice... You've reduced my stress by a ton."

Josh, Real Estate Investor

Maximized deductions with cost segregation on four new properties ($38K in tax savings)

"I did all four cost segregations for the four newly acquired properties for 2024... learning how to use a profit loss statement, that was tremendous because it really helped me figure out... what type of business expense it is."

Johanna, STR Investor

$89,755 in tax savings leveraging strategic investments and entity restructuring

It is an amazing community out there. You're never alone... you always wonder like, what am I going to do if X, Y, and Z happens? There are so many people out there that are willing to help and offer guidance... just reach out within probably 30 minutes. I have a response."

Johanna, STR Investor

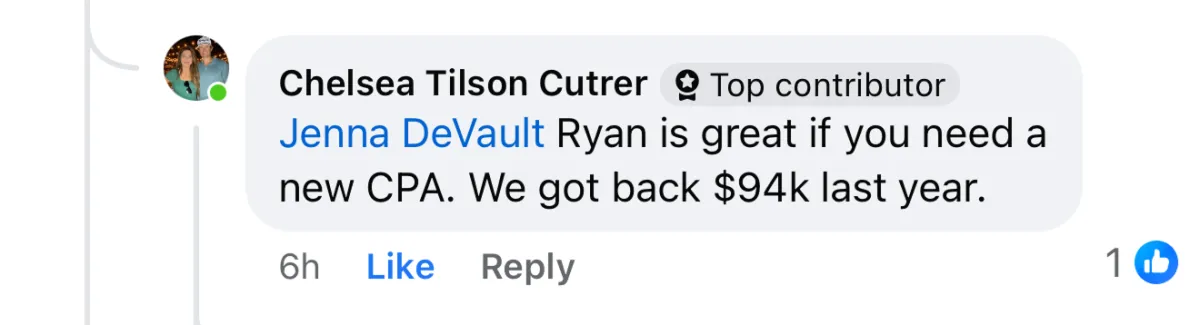

MEET THE BUDGETDOG

TAX TEAM

"Your taxes deserve more than a box-checker. That's why every CPA on our team is handpicked—vetted for years of experience, specialized in working with business owners and real estate investors, and trained to think like a strategist. When you work with us, this is the level you get."

Ryan Bakke, CPA

CPA License Number: 065.056353

Former Tax Consultant at Deloitte. Ryan has guided over 1,000 families toward financial freedom - and he practices what he preaches, with 13 rental properties and investments in multiple CPA firms. He's not just advising from the sidelines. He's in the game

with you.

Co-Founder & Tax Advisor

Tanner Dean Van Maanen, CPA

CPA License Number: O14872

Former manager at a Big 4 firm. Now bringing that same level of expertise to business owners and real estate investors who actually need it. Tanner has handled tax strategy for large asset management companies and small businesses and investors alike - so whether you're scaling up or already there, he's seen your situation before.

Tax Advisor

WHAT IS BUDGETDOG TAX

& ADVISORY

Budgetdog Tax & Advisory is a year-round strategic tax positioning service for real estate investors, business owners, and high-earning professionals (interested in real estate or starting a business), paying $30,000+/year in taxes.

You work hard for your money. We help you keep more of it.

Here's how:

We analyze everything: your income, your business, your investments, your decisions.

We identify where you're overpaying and opportunities to capture it back.

We build a strategy and hand you the step-by-step plan.

Maybe it's restructuring your entity in Q1.

Optimizing business expenses in Q2.

Positioning retirement accounts in Q3.

Timing income and deductions in Q4.

Could be real estate strategies. Cost segregation. Short-term rental loopholes.

Depends on your situation. Everything we do is custom-made (no cookie-cutter methods).

We build the strategy. You implement. We monitor.

Between quarters, you have unlimited CPA access.

Questions get answered within 48 hours. Many same-day.

You get access to the community and educational resources so you can see clearly what we're doing and why it works.

At year-end, we execute final moves and prepare your return.

Based on a full year of positioning. Not April panic.

As a result...

More money stays with you every year instead of going to the IRS.

The end goal of Budgetdog Tax is to build you a proactive tax system that saves you money on taxes...

Takes only 30 minutes per quarter to manage once implemented, and redirects those tax savings into wealth-building investments that compound over decades.

You'll have complete clarity, confidence, and control over your tax situation, knowing every decision is optimized before you make it.

WE HELP YOU WITH...

Legally reduce your tax burden through entity optimization, cost segregation, and strategic timing

Gain clarity on exactly which business expenses maximize deductions without audit risk

Eliminate surprise tax bills through quarterly planning and proactive adjustments

Build generational wealth faster by redirecting tax savings into investments

Access 24/7 CPA support instead of waiting weeks for email responses

Full confidence - every decision is tax-optimized before you make it

Unlimited strategic support (no pay per consult or hidden fees)

Strategic partnership mindset - we work WITH your financial advisor, real estate team, and business partners - not against them.

WHAT OTHERS THINK ABOUT

BUDGETDOG TAX

Saved $33,000 in taxes with cost segregation

"Before I started working with you I really felt like I was in the dark... I had like zero knowledge... I didn't even know what a cost segregation was. The benefits [of working with you]... was of course the cost segregation, like being able to save money on taxes... and then another benefit is just being able to have someone there as support."

Audrey, Travel Nurse

Caught a $24,000 mistake by another tax firm

"They insisted that they had experience with short-term rentals... my first tax return came in and I would have gotten $6,000 back... I thought 'that looks a little weird.' They'd forgot my cost segregation study... they had put my short-term rental on my schedule E instead of my schedule C... Now I'm getting $24,000 back from the government... that's a very significant difference."

Amy, Teacher

Transitioned from W2 to full-time real estate with strategic tax planning ($98K in tax savings)

"It's been kind of interesting being a client of yours and just making the transition from a W2 to doing short-term rentals full-time and then... now it's a pretty big business that I'm growing."

Kathi, STR Investor

Offset his lifetime pension with real estate deductions

"It really set me in the position to be able to offset my lifetime pension with my real estate so that... I don't have to pay as much to Uncle Sam... being educated and understanding how to use it is key and very clutch."

Glenn, Real Estate Investor

Finally found a CPA who gives practical advice

"You are far and away the best CPA I've ever worked with... I've been through probably four or five... I tried going to tax attorneys before and it's always like 'well it kind of depends' rather than just practical advice... You've reduced my stress by a ton."

Josh, Real Estate Investor

Eliminated capital gains taxes with a "lazy 1031" strategy

"We had a long-term rental that we ended up selling... and we won't have to pay any taxes on the capital gains we got on that property... had I not signed up with you in August, I don't know if any of this would be possible."

Johanna, STR Investor

Maximized deductions with cost segregation on four new properties ($38K in tax savings)

"I did all four cost segregations for the four newly acquired properties for 2024... learning how to use a profit loss statement, that was tremendous because it really helped me figure out... what type of business expense it is."

Alex, Real Estate Investor

$89,755 in tax savings leveraging strategic investments and entity restructuring

It is an amazing community out there. You're never alone... you always wonder like, what am I going to do if X, Y, and Z happens? There are so many people out there that are willing to help and offer guidance... just reach out within probably 30 minutes. I have a response."

Sheena, STR Investor

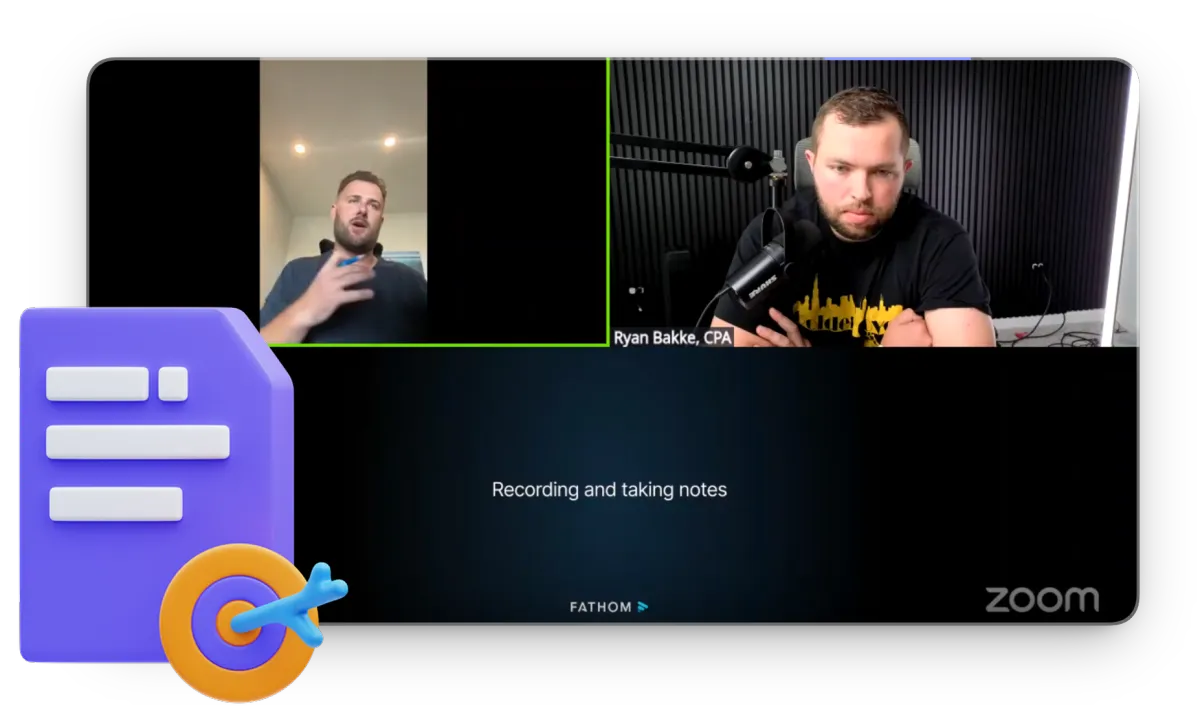

MEET THE BUDGDETDOG TAX TEAM

"Your taxes deserve more than a box-checker. That's why every CPA on our team is handpicked—vetted for years of experience, specialized in working with business owners and real estate investors, and trained to think like a strategist.

When you work with us, this is the level you get."

Ryan Bakke, CPA

CPA License Number: 065.056353

Former Tax Consultant at Deloitte. Ryan has guided over 1,000 families toward financial freedom - and he practices what he preaches, with 13 rental properties and investments in multiple CPA firms. He's your go-to expert for navigating business acquisitions, sales, and rental property deals from start to finish.

Co-Founder & Tax Advisor

Tanner Dean Van Maanen, CPA

CPA License Number: O14872

Former manager at a Big 4 firm. Now bringing that same level of expertise to business owners and real estate investors who actually need it. Tanner has handled tax strategy for large asset management companies and small businesses and investors alike - so whether you're scaling up or already there, he's seen your situation before.

Tax Advisor

WHAT IS BUDGETDOG TAX & ADVISORY

Budgetdog Tax & Advisory is a year-round strategic tax positioning service for real estate investors, business owners, and high-earning professionals (interested in real estate or starting a business), paying $30,000+/year in taxes.

You work hard for your money. We help you keep more of it.

Here's how:

We analyze everything: your income, your business, your investments, your decisions.

We identify where you're overpaying and opportunities to capture it back.

We build a strategy and hand you the step-by-step plan.

Maybe it's restructuring your entity in Q1.

Optimizing business expenses in Q2.

Positioning retirement accounts in Q3.

Timing income and deductions in Q4.

Could be real estate strategies. Cost segregation. Short-term rental loopholes.

Depends on your situation. Everything we do is custom-made (no cookie-cutter methods).

We build the strategy. You implement. We monitor.

Between quarters, you have unlimited CPA access.

Questions get answered within 48 hours. Many same-day.

You get access to the community and educational resources so you can see clearly what we're doing and why it works.

At year-end, we execute final moves and prepare your return.

Based on a full year of positioning. Not April panic.

As a result...

More money stays with you every year instead of going to the IRS.

The end goal of Budgetdog Tax is to build you a proactive tax system that saves you money on taxes...

Takes only 30 minutes per quarter to manage once implemented, and redirects those tax savings into wealth-building investments that compound over decades.

You'll have complete clarity, confidence, and control over your tax situation, knowing every decision is optimized before you make it.

WE HELP YOU WITH...

Legally reduce your tax burden through entity optimization, cost segregation, and strategic timing

Gain clarity on exactly which business expenses maximize deductions without audit risk

Eliminate surprise tax bills through quarterly planning and proactive adjustments

Build generational wealth faster by redirecting tax savings into investments

Access 24/7 CPA support instead of waiting weeks for email responses

Full confidence - every decision is tax-optimized before you make it

Unlimited strategic support (no pay per consult or hidden fees)

Strategic partnership mindset - we work WITH your financial advisor, real estate team, and business partners - not against them.

HOW DOES THIS WORK?

BudgetDog Tax gives you everything you need to legally minimize your tax burden and accelerate wealth building

Custom Tax Strategy Session

1-on-1 deep-dive consultation where we audit your current tax situation, entity structure, and identify immediate opportunities. We build your personalized tax roadmap based on your specific income sources, business model, and financial goals - not generic cookie-cutter advice.

Year-Round Strategic Planning

Quarterly planning sessions (minimum) to proactively position you before tax events happen. We don't wait until December to tell you what you should have done in January. Every major decision gets tax-optimized before you execute.

Weekly CPA Access

Live weekly office hours calls where you can ask questions, get strategy updates, and learn alongside other high-earners. Unlike traditional CPAs who take 2-3 weeks to respond, you get answers when you need them.

48-Hour Response Portal

Submit any question, document, or scenario into our secure tax portal and receive detailed responses from our CPA team within 48 hours maximum (usually same-day). No more "let me get back to you in a few weeks" runaround.

Proactive Strategy Delivery

2-3 emails per week with tax-saving opportunities specific to your situation. We actively monitor tax law changes, real estate strategies, business deductions, and retirement optimizations - then send you actionable recommendations you can implement immediately.

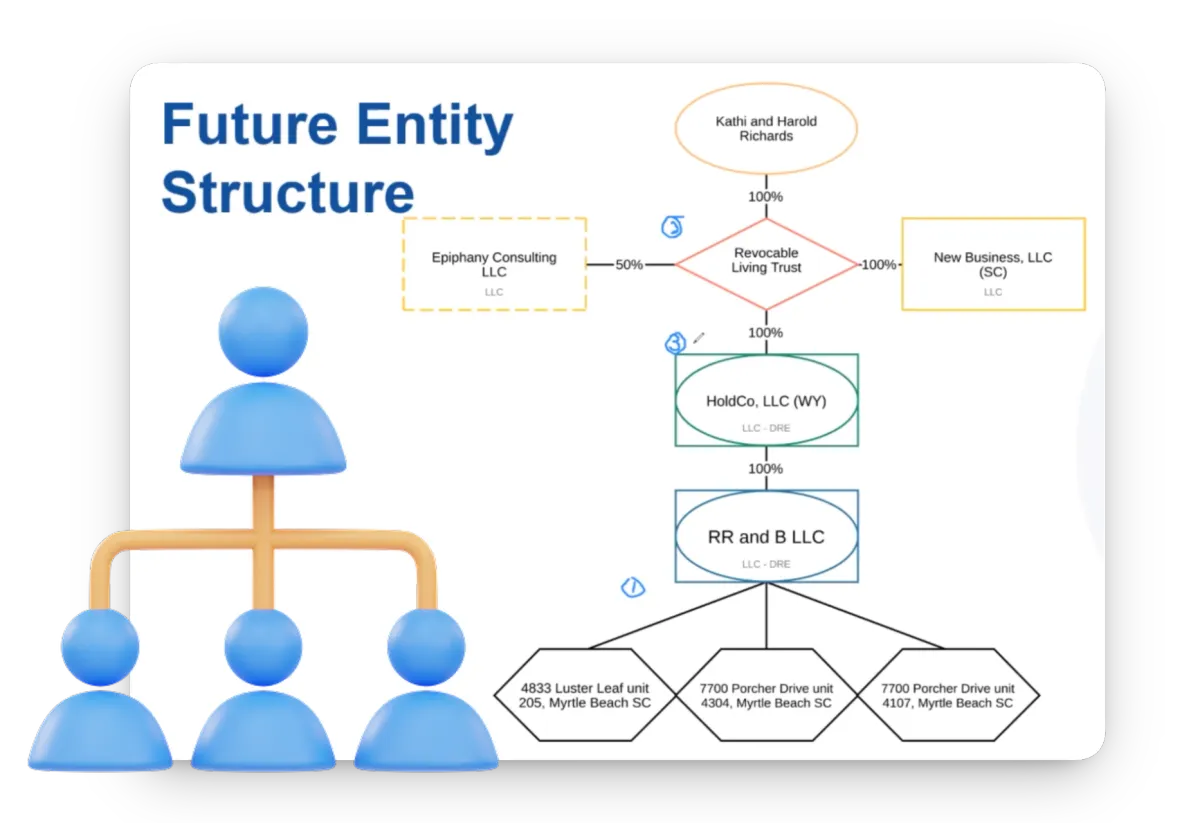

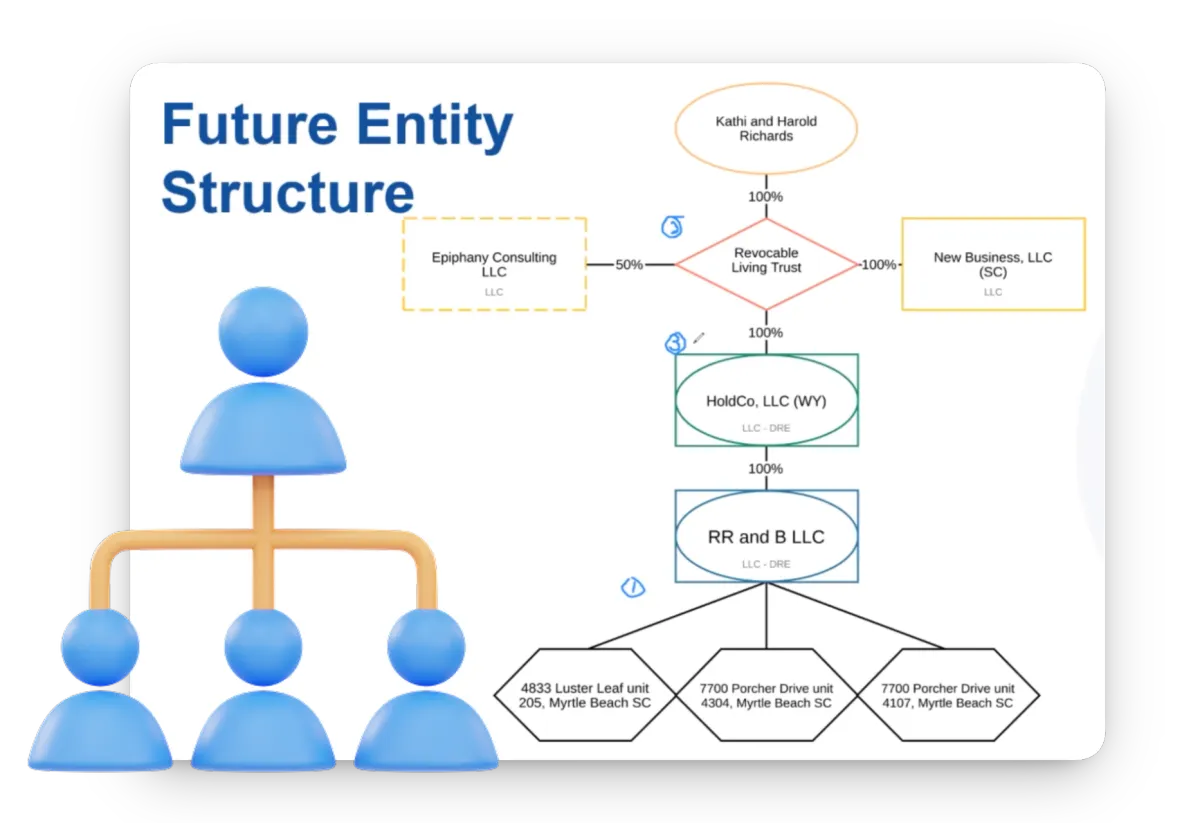

Entity Structure Optimization

Complete audit and recommendations for your business entities (LLC, S-Corp, C-Corp, partnerships). We'll restructure if needed or confirm you're optimized. Includes guidance on multi-state operations, holding companies, and asset protection strategies.

Advanced Real Estate Strategies

- Cost segregation studies to accelerate depreciation

- Short-term rental tax loophole implementation (deduct losses against W-2 income)

- Real estate professional status qualification and documentation

- 1031 exchange planning and execution support

- Rental property expense maximization

Business Tax Optimization

- S-Corp election timing and reasonable compensation calculations

- Section 179 and bonus depreciation planning

- Home office deduction structuring

- Vehicle expense optimization

- Family member hiring strategies

- Augusta Rule implementation (rent home to business tax-free)

Retirement & Investment Tax Strategy

- Roth conversion ladder planning during low-income years

- Backdoor Roth IRA execution

- Solo 401(k) and SEP IRA optimization for business owners

- HSA triple-tax-advantage maximization

- Tax-loss harvesting in taxable accounts

Year-End Tax Preparation

When tax season arrives, we're not scrambling - we're executing the plan we built all year. Your return is informed by 12 months of strategic positioning, not last-minute panic. Preparation is included in your annual partnership.

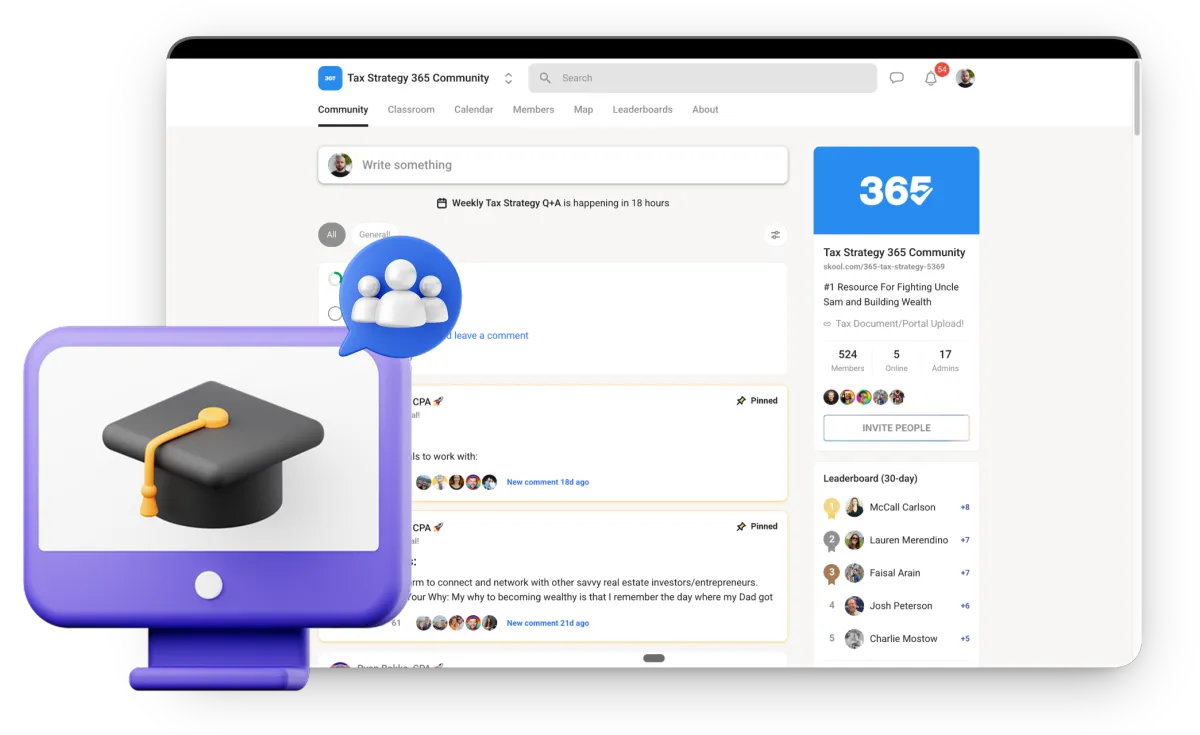

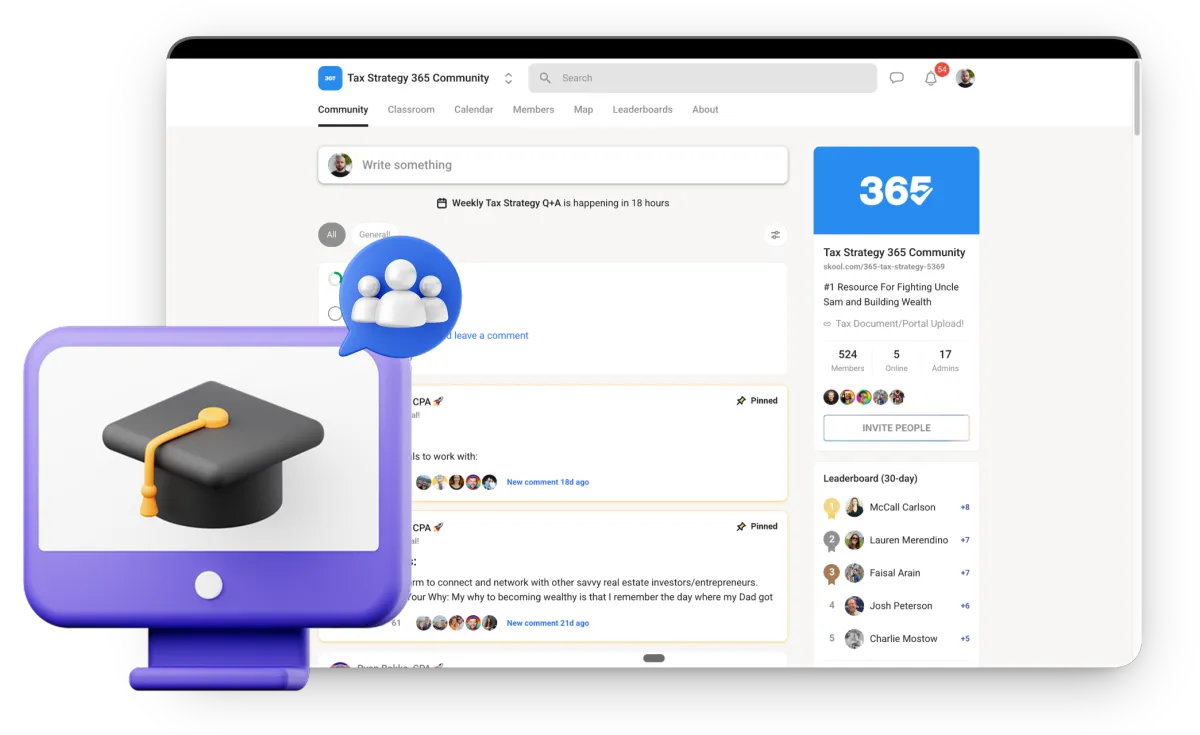

Community & Educational Resources

Access to our private community of business owners, investors, and high-earners implementing the same strategies. Learn from others' wins, ask questions, and get peer support. Includes archived strategy sessions and educational content library.

Integration with

Financial Plan

For BudgetDog Academy students, we integrate seamlessly with your existing financial roadmap ensuring your tax strategy, investment strategy, and wealth-building plan all work together (not in silos like most people experience).

HOW DOES THIS WORK?

BudgetDog Tax gives you everything you need to legally minimize your tax burden and accelerate wealth building

Custom Tax Strategy Session

1-on-1 deep-dive consultation where we audit your current tax situation, entity structure, and identify immediate opportunities. We build your personalized tax roadmap based on your specific income sources, business model, and financial goals - not generic cookie-cutter advice.

Year-Round Strategic Planning

Quarterly planning sessions (minimum) to proactively position you before tax events happen. We don't wait until December to tell you what you should have done in January. Every major decision gets tax-optimized before you execute.

Weekly CPA Access

Live weekly office hours calls where you can ask questions, get strategy updates, and learn alongside other high-earners. Unlike traditional CPAs who take 2-3 weeks to respond, you get answers when you need them.

48-Hour Response Portal

Submit any question, document, or scenario into our secure tax portal and receive detailed responses from our CPA team within 48 hours maximum (usually same-day). No more "let me get back to you in a few weeks" runaround.

Proactive Strategy Delivery

2-3 emails per week with tax-saving opportunities specific to your situation. We actively monitor tax law changes, real estate strategies, business deductions, and retirement optimizations - then send you actionable recommendations you can implement immediately.

Entity Structure Optimization

Complete audit and recommendations for your business entities (LLC, S-Corp, C-Corp, partnerships). We'll restructure if needed or confirm you're optimized. Includes guidance on multi-state operations, holding companies, and asset protection strategies.

Advanced Real Estate Strategies

- Cost segregation studies to accelerate depreciation

- Short-term rental tax loophole implementation (deduct losses against W-2 income)

- Real estate professional status qualification and documentation

- 1031 exchange planning and execution support

- Rental property expense maximization

Business Tax Optimization

- S-Corp election timing and reasonable compensation calculations

- Section 179 and bonus depreciation planning

- Home office deduction structuring

- Vehicle expense optimization

- Family member hiring strategies

- Augusta Rule implementation (rent home to business tax-free)

Retirement & Investment Tax Strategy

- Roth conversion ladder planning during low-income years

- Backdoor Roth IRA execution

- Solo 401(k) and SEP IRA optimization for business owners

- HSA triple-tax-advantage maximization

- Tax-loss harvesting in taxable accounts

Year-End Tax Preparation

When tax season arrives, we're not scrambling - we're executing the plan we built all year. Your return is informed by 12 months of strategic positioning, not last-minute panic. Preparation is included in your annual partnership.

Community & Educational Resources

Access to our private community of business owners, investors, and high-earners implementing the same strategies. Learn from others' wins, ask questions, and get peer support. Includes archived strategy sessions and educational content library.

Integration with

Financial Plan

For BudgetDog Academy students, we integrate seamlessly with your existing financial roadmap ensuring your tax strategy, investment strategy, and wealth-building plan all work together (not in silos like most people experience).

Budgetdog Tax & Advisory PLLC is not a CPA firm and does not provide attestation services. The materials on this website are provided “as is.” Budgetdog Tax & Advisory PLLC makes no representations regarding the accuracy or reliability of the information presented and is not responsible for the content of any third‑party links. Please refer to our Privacy Policy for additional details. Viewing this site does not create a client relationship. All information is for general educational purposes only and should not be considered tax advice.

Budgetdog Tax & Advisory PLLC is not a CPA firm and does not provide attestation services. The materials on this website are provided “as is.” Budgetdog Tax & Advisory PLLC makes no representations regarding the accuracy or reliability of the information presented and is not responsible for the content of any third‑party links. Please refer to our Privacy Policy for additional details. Viewing this site does not create a client relationship. All information is for general educational purposes only and should not be considered tax advice.